Products List

- Product

- Qty in Cart

- Quantity

- Price

- Subtotal

-

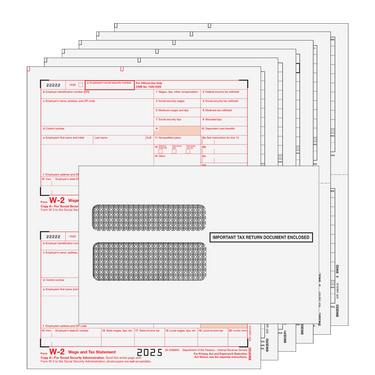

Traditional W-2 Form Preprinted 6-part Kit (with Moisture Seal Envelopes)

W2TRADS6EG$49.20Form W2 Traditional Kit. This 6-part laser set includes: Employer Copy A (federal, red scannable) Employee Copy B (federal) Employee Copy C (file) Employer Copy 1 (state city local) Employee Copy 2 (state city local) Double Window Moisture Seal... -

Traditional W-2 Form 4-part Set (Blank Copies with Instructions)

TRDSET4I05$25.92Form W2 Blank 4-Part Set. This sets includes preprinted Federal Copy A forms and enough blank paper to print additional copies for the Employee and Employer. Included in this set is: Preprinted W-2 copy A (red scannable) 2 Blank 2-up sheets... -

Preprinted W-2 Form 6-part Kit (with Moisture Seal Envelopes) - 10 quantity

W2TRD6E10$90.80Traditional W-2 Form Kit. This kit is ideal when filing for up to 50 recipients. It includes everything you need to report employee wages to the IRS and your recipients. This kit includes: 10 Employer Copy A (federal) 10 Employee Copy B... -

Traditional W-2 Preprinted 8-part Kit (with Moisture Seal Envelopes)

W2TRADS8EG$59.92Form W2 Traditional Kit. This 8-part laser set includes: (1) Preprinted Employer Copy A (federal, red scannable) (1) Preprinted Employee Copy B (federal) (1) Preprinted Employee Copy C (file) (1) Preprinted Employer Copy D (records) (2) Preprinted... -

Traditional W-2 Form 8-part Set (Preprinted)

W2TRADS805$16.52Form W2 Preprinted 8-Part Set. This 8-part traditional preprinted laser set includes 2-up forms: (1) Employer Copy A (red scannable) (1) Employee Copy B (federal) (1) Employee Copy C (file) (1) Employer Copy D (records) (2) Employer... -

Form W-3 Transmittal Employers Federal

BW305$0.00Form W-3 - Transmittal of Wage and Tax Statement. Use the W-3 form to summarize W-2 information for the SSA. You must complete one W-3 form for each employer. Forms do not have perforations and are required to be preprinted with red scannable ink... -

Form W-3 Transmittal Employers Federal 2-part (Carbonless)

W3052$2.82Form W-3 - Transmittal of Wage and Tax Statement. Use the W-3 form (Transmittal of Wage and Tax Statements) to summarize W-2 information for the SSA. You must complete one W-3 form for each employer. Forms do not have perforations and are required... -

Form W-2C Corrected Employer Record, Copy D

80075$10.12Form W-2C - Corrected Wage & Tax Statement. Use the W-2C form to correct information filed on the original W-2 form. Forms are 1-Up sheets with no side perforations and are preprinted with black ink. You fill in the year you are correcting. The... -

Form W-2C Corrected Federal IRS, Copy A

BW2C05$10.12Form W-2C - Corrected Wage & Tax Statement. Use the W-2C form to correct information filed on the original W-2 form. Forms are 1-Up sheets with no side perforations and are preprinted with red ink. Use Copy A for federal filing. You fill in the... -

Form W-2C Corrected Employee Record, Copy C

80074$10.12Form W-2C - Corrected Wage & Tax Statement. Use the W-2C form to correct information filed on the original W-2 form. Forms are 1-Up sheets with no side perforations and are preprinted with black ink. You fill in the year you are correcting. The... -

Form W-2C Corrected Employee, State, City, Local, Copy 2

80077$10.12Form W-2C - Corrected Wage & Tax Statement. Use the W-2C form to correct information filed on the original W-2 form. Forms are 1-up sheets with no side perforations and are preprinted with black ink. The employee uses Copy 2 for filing with... -

Form W-2C Corrected Employee Federal, Copy B

80073$10.12Form W-2C - Corrected Wage & Tax Statement. Use the W-2C form to correct information filed on the original W-2 form. Copy B is for the employee's federal submission. You fill in the year you are correcting. Forms are 1-up sheets with no side...